Tracking stock market trends is essential for successful investing, and Parker-Hannifin Corporation is no exception. The PH stock price is closely watched by investors due to the company’s consistent performance and global industrial presence. Analyzing trends, charts, and technical indicators can provide deeper insight into future price movements.

Understanding Price Trends

Stock price trends reveal the overall direction of a stock’s movement over time. Parker-Hannifin has historically demonstrated a strong upward trend, supported by revenue growth and operational efficiency. Long-term investors often look for higher highs and higher lows as signs of sustained growth.

Short-term trends, on the other hand, may reflect market sentiment, earnings announcements, or economic data releases. Understanding both timeframes helps investors align their strategies accordingly.

Technical Chart Analysis

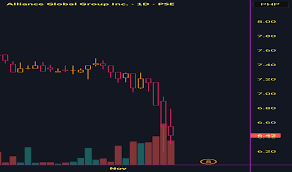

Charts are powerful tools for visualizing price behavior. Commonly used charts include line charts, candlestick charts, and bar charts. Technical indicators such as moving averages, RSI, and MACD are frequently applied to analyze the PH stock price.

For example, when the stock trades above its 50-day and 200-day moving averages, it often signals bullish momentum. Conversely, breakdowns below key support levels may indicate potential downside risk.

Volume and Market Sentiment

Trading volume provides insight into the strength of price movements. Rising volume during price increases suggests strong buying interest, while declining volume may signal weakening momentum. Monitoring volume trends alongside price charts can help confirm breakouts or reversals.

Market sentiment also plays a crucial role. Positive sentiment driven by strong earnings or industry growth can push the PH stock price higher, while negative sentiment may cause temporary declines.

Fundamental Analysis

Beyond technical charts, fundamental analysis remains essential. Key metrics such as earnings per share, revenue growth, operating margins, and debt levels provide a comprehensive view of the company’s financial health. Parker-Hannifin’s strong cash flow and disciplined capital allocation have historically supported shareholder value.

If you wish to track the Parker-Hannifin Corporation stock price (PH stock price). you can visit Bitget’s stock price page to view the latest stock price information and trends. This page can also serve as a reference for your buying and selling decisions.

Risk Factors

While trends may appear favorable, investors should remain aware of risks. Economic slowdowns, supply chain disruptions, and rising interest rates can impact industrial companies. Diversification and risk management strategies are essential when investing in stocks like PH.

Conclusion

Analyzing trends, charts, and financial data provides valuable insight into the PH stock price. By combining technical and fundamental analysis, investors can better understand market behavior and make informed decisions. Parker-Hannifin’s long-term performance continues to make it a stock worth monitoring.